Choosing the Right Insurance Outsourcing Companies: A Decision-Maker’s Guide

Insurance Virtual Assistant

The insurance landscape changes quickly since customer needs transform alongside tech advances. This transformation created both opportunities and challenges. Small-to-midsize insurance agencies and brokers strive to stay competitive. Because businesses must navigate through these changes, many turn to insurance outsourcing companies to optimize operations, reduce costs, and focus on core activities.

Research and Markets say that the global insurance business process outsourcing (BPO) market grew from about $12.7 billion in 2023. It reached by then $14.0 billion in 2024. It is expected by 2030 that it will exceed $26.1 billion because 40.9% of that growth is from just the P&C insurance segment.

Because it is the case that the market is quite competitive, it can be a challenge to choose the right insurance outsourcing company. This guide is one that will help you to make an informed decision because it highlights the way that partnering with the right insurance outsourcing companies can drive efficiency and can add meaningful value for your business.

Table of Contents

What Is Insurance Outsourcing?

Insurance outsourcing, also known in the form of insurance BPO, means that companies can delegate specific tasks or operational processes to external experts or firms. Insurance businesses are able to concentrate upon high-value activities such as acquiring and then retaining customers.

Third-party companies manage time-consuming tasks with this approach. Many insurance outsourcing companies also provide specialized services such as insurance virtual assistants because these assistants support back-office operations plus customer interactions for improved efficiency along with responsiveness.

Commonly Outsourced Services:

- Customer Service: It assists in regard to inquiries as well as policy-related questions plus support.

- Policy Management handles renewals, endorsements, also updates. This ensures smooth coverage to all involved parties.

- Policy Administration includes duties such as policy issuance plus endorsements. Renewals are also included.

- Back-Office Operations: Policy documentation, duties of reconciliation, and data entry.

- Certificate Processing: Issuance along with validation of Certificate of Insurance (COI) handled efficiently.

- Timely accurate updates are ensured by managing the renewal process for policies.

- Proactive Carrier Communication Management: Higher Retention and an Increase in Compliance with Carrier Updates. Updating policies accurately is ensured by proactive carrier communication, which supports compliance and reduces errors.

- Insured’s Requests: Various requests from insured clients are handled in an efficient manner; policy changes as well as endorsements and even inquiries are included so as to improve customer satisfaction and also retention.

Businesses are able to tap into a more specialized expertise through outsourcing of back office solutions instead of hiring a large in-house staff. By use of this strategy, overhead costs are reduced in a large way.

Key Benefits of Insurance Outsourcing

Insurance outsourcing companies like Assuretrac offer significant benefits by improving operational efficiency, ensuring compliance, enabling scalability, and helping businesses cut costs. By outsourcing, companies can save money and optimize operations. This is achieved by offering cost-effective solutions tailored specifically for small insurance agencies and firms. Efficient management of administrative duties through outsourcing allows businesses to focus on customer engagement and growth.

In addition, insurance outsourcing companies ensure business continuity by playing a key role during crises. Their services support operational resilience and complement disaster recovery plans, helping businesses maintain smooth operations even in challenging times. Outsourcing is becoming a calculated solution for many insurance firms.

1. Cost Savings

Insurance outsourcing companies save businesses meaningful costs by reducing the need for large in-house teams dedicated to administrative and operational tasks. Companies can access specialized expertise on demand through outsourcing, avoiding long-term costs associated with recruiting, training, and maintaining full-time employees.

A 2024 ISG report states that insurance outsourcing programs save about 15% in costs on average. Policy administration and processing automation can also cut costs by 30% to 40%. Therefore, partnering with insurance outsourcing companies is a smart way to optimize operations and reduce overhead expenses.

2. Increased Efficiency

Specialized insurance outsourcing companies have the latest tools and also have highly trained professionals, so that efficiency is increased. Workflows are now streamlined, deliverables are mostly error-free, and turnaround times will become faster.

Insurance agencies improve accuracy along with operational capacity when they outsource routine tasks like policy administration, data entry, along with certificate processing to these insurance outsourcing companies, for this allows internal teams to focus on calculated priorities along with customer engagement through modern technologies like data analytics, automation, along with artificial intelligence.

Digitally enabled BPO insurance providers have reduced policy processing times by 40 to 50%. This quickens procedures for P&C agencies.

3. Access to Expertise

Third-party providers bring industry-specific knowledge as they do use advanced technologies with expert capabilities through their own global resource pool.

In 2028 it is expected that 50% of insurance staff will retire. Since the industry faces such a critical staffing shortfall, especially in risk management, outsourcing offers access to such trained talent.

For example, Assuretrac, among other insurance outsourcing service providers, provides AI-driven solutions so workflows become optimized in that insurance operations become compliant.

4. Improved Compliance

Staying compliant with changing regulations matters since insurance outsourcing companies must be in compliance. These providers typically have strong process management coupled with compliance frameworks along with necessary certifications. By working in close proximity with insurance carriers, they do effectively handle this responsibility, thereby reducing risk for your business.

5. Focus on Core Activities

Outsourcing administrative and back office tasks and solutions allows you to redirect internal resources because you are able to focus in on core competencies, such as client acquisition, planned planning, and service differentiation for clients.

Challenges of Insurance Outsourcing (and How to Overcome Them)

Many advantages come from insurance outsourcing companies, but a few problems happen too. Decision-makers should come to a comprehension of all possible dangers as well as a number of challenges tied to outsourcing for maximizing efficiency. They should also take proactive steps for addressing those risks along with challenges.

1. Data Security Risks

Handling sensitive client information is a key part of outsourced tasks, so data management as well as customer experience are top priorities now. Working alongside insurance outsourcing companies is important if those companies strictly protect data using encryption protocols and comply with industry standards like GDPR.

In , 37 of the U.S. states do require licensing for third-party administrators (TPAs) that do manage insurance operations. It stresses that due diligence is key when selecting a compliant outsourcing partner.

2. Communication Barriers

Outsourcing across time zones or regions may cause for communication to be challenging, so interacting with customers in a high-quality way is important to independent agents. Well-established collaboration processes as well as dedicated support coming from your provider are surely ensured.

3. Loss of Control

Some organizations can feel disconnected from client relationships upon delegating tasks. This delegation may affect critical workflows. Providers having clearly defined SLAs plus transparent reporting can alleviate these concerns.

How to Choose the Right Insurance Outsourcing Company

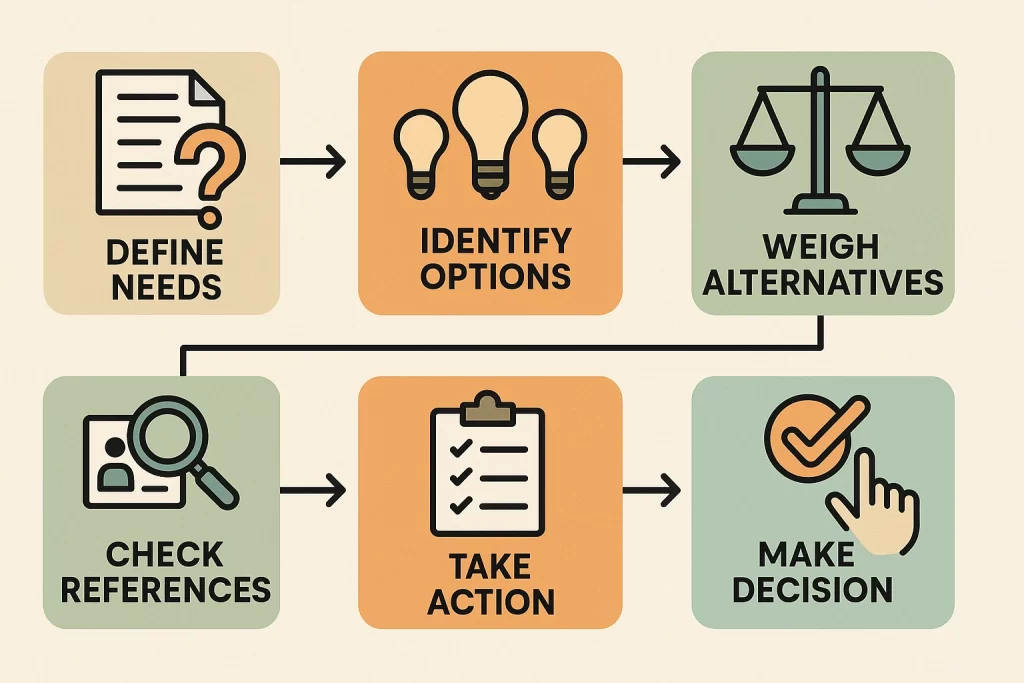

Selecting the ideal outsourcing solutions and insurance process outsourcing partner requires thorough evaluation and planning. Focus on how insurance outsourcing companies will drive your digital transformation. Consider available choices and understand that these outsourcing companies improve your operations through automation and AI-driven technologies.

1. Define Your Needs

Begin by identifying the specific tasks that you want to outsource such as policy administration, customer service, or data entry. It is because you partner with insurance outsourcing companies that it can help you to reduce operational costs and also improve efficiency when you streamline back-office operations. To create a well-defined list regarding requirements, clearly outline desired outcomes, goals, also your objectives.

Begin by identifying the specific tasks that you want to outsource such as policy administration, customer service, or data entry.

It is because you partner with insurance outsourcing companies that it can help you to reduce operational costs and also improve efficiency when you streamline back-office operations. To create a well-defined list regarding requirements, clearly outline desired outcomes, goals, also your objectives.

2. Research Potential Providers

For the insurance sector, look toward outsourcing companies with proven track records. They also must have quite an outstanding standing among the insurance providers. Read testimonials, case studies, and reviews for assessing their reliability.

Assuretrac is a budget-friendly outsourcing provider as well as one that specializes in insurance process outsourcing.

3. Assess Expertise and Experience

Be sure that the provider has experience in the handling of insurance processes. Also, the provider should provide underwriting support. Do similar industries or companies partner with them? For example, Assuretrac specializes in MGAs, InsurTechs, and carriers, plus the company, one of the leading insurance outsourcing companies, combines industry-specific experience with its AI-powered solutions.

4. Evaluate Technology Capabilities

Prioritize insurance outsourcing companies as well as insurance BPO providers when they offer services that leverage advanced technologies like AI and automation so processes streamline. Insurance outsourcing companies should use advanced digital tools like six sigma tools and advanced analytics to make operations more efficient. AI should also be used by them for document management and workflow automation, also back office cloud-based software for scalability.

Assuretrac provides a complete group of services, helping insurance agencies and carriers to streamline procedures. Its back-office support includes policy modifications along with endorsements as well as cancellations. AMS updates as well as certificate issuing and carrier updates are also included in order to improve accuracy and efficiency.

For new business, Assuretrac provides automated quoting systems with onboarding assistance, and this assistance includes the creation of welcome packages to ensure a smooth client experience. Additionally, their renewal preparation services help clients through remarketing and renewal summaries. Also, these services allow clients to maintain strong client retention via payment follow-ups.

Assuretrac uses a compliance-first approach plus cutting-edge technology with these services so it gives scalable, reliable, secure insurance business process outsourcing solutions made to suit changing insurance industry needs.

5. Consider Security and Compliance

Ensure that the provider adheres to industry regulations also follows security protocols with strict risk management. Ask regarding certifications such as ISO 27001 also SOC 2. Also ask questions with regard to GDPR compliance.

Regulators stress insurers are not going to be absolved of all their legal responsibilities in regard to outsourcing. It is vital for you to partner with only those firms that in actuality are holding certifications such as ISO 27001 as well as SOC 2 displaying strong compliance practices. (Source: NAIC Big Data Working Group)

6. Check References

Ask for references including gathering perceptions reaching out to past or existing clients. For success in the insurance business, one must have industry-specific experience. This experience proves to be important in this field. Were deadlines met on schedule by the provider? Did the services provided satisfy? Indispensable to success is honest feedback from fellow professionals.

Why Assuretrac Is Your Ideal Partner

At Assuretrac, we do specialize in those insurance BPO services that are quite reliable and scalable and compliant for use by the insurance industry.

Advanced Technology Solutions

Our platform employs cutting-edge technologies for improving operational efficiency also simplify complex workflows. These technologies aid choices grounded in data. We focus on how to streamline processes and to digitally transform so as to help your business thrive.

Comprehensive Services

- Back-Office Support: Policy modifications, endorsements, cancellations, AMS updates, certificate issuing, carrier updates, and other administrative tasks to enhance efficiency and accuracy.

- New Business Support: Automated quoting systems and onboarding support like building welcome packages.

- Renewal Preparation: Remarketing, renewal summaries, and payment follow-ups to ensure a high retention rate.

Compliance-First Approach

We prioritize data security as well as compliance as we approach structured business process outsourcing, and we meet each of the regulatory standards in order to minimize risk for all of our clients. Industries in handling of sensitive customer information are in need of this. This is just something that is in fact critical.

Client Success Stories

The Future of Insurance Outsourcing

As the insurance industry adapts to changes, insurance outsourcing companies are becoming increasingly relevant. They promote scalability, ensure compliance, and develop efficiency by managing time-consuming tasks. Agencies can stay competitive and prepare for the future by leveraging modern technology. Partnering with leading providers like Assuretrac and Resource Pro will help you stay ahead.

Since 80% of insurers are adopting or plan to adopt AI in their operations, outsourcing providers with automation and analytics will be key players in shaping the next chapter of the insurance industry.

Take the Next Step

If you’re ready to transform your operations, Assuretrac is here to help you focus on your core activities also improve revenue generation. You can learn more of our tailored solutions. Alternatively, you can schedule for yourself a consultation with just one of our experts today.